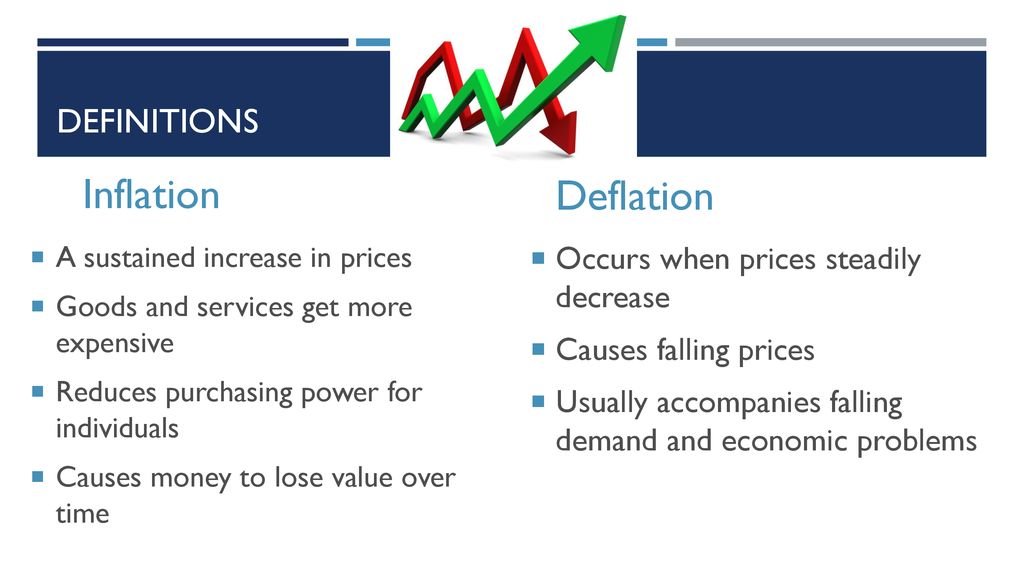

In the intricate tapestry of global economics, the movement of prices is a critical indicator of health and stability. Most commonly, we hear of inflation—the persistent rise in the general price level of goods and services. However, the economic lexicon extends to two other, often more perplexing, conditions: deflation and stagflation. While both represent deviations from a desired state of stable economic growth and moderate inflation, their underlying causes, symptoms, and prescribed remedies are starkly different, carrying profound implications for individuals, businesses, and governments alike.

Deflation, in essence, is the opposite of inflation: a sustained decrease in the general price level of goods and services. While seemingly beneficial at first glance—who wouldn't want cheaper goods?—deflation can signal deep-seated economic woes. It often arises from a significant contraction in the money supply, a severe drop in aggregate demand, or an oversupply of goods. The consequences can be dire: consumers delay purchases anticipating even lower prices, businesses face declining revenues and profits, leading to production cuts and layoffs. This can spiral into a deflationary trap, where falling prices lead to reduced spending, which further lowers prices, suffocating economic growth and increasing the real value of debt, making it harder to repay.

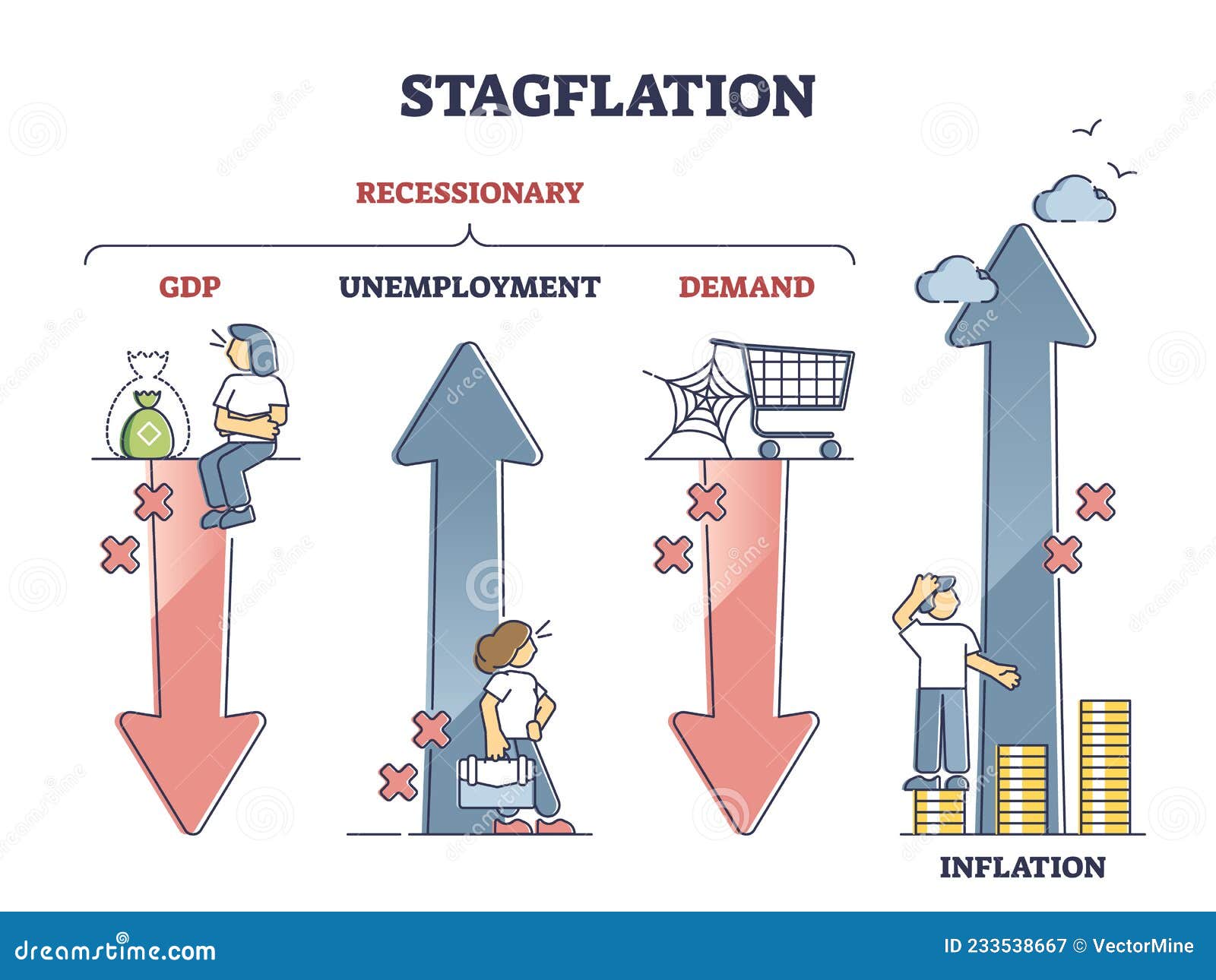

Stagflation presents a far more insidious challenge, characterized by the simultaneous occurrence of three undesirable economic phenomena: stagnant economic growth (often accompanied by high unemployment), high inflation, and declining demand. This seemingly contradictory state puzzled economists when it first emerged prominently in the 1970s, as conventional wisdom held that inflation and unemployment moved in opposite directions. The causes of stagflation are complex, often attributed to supply shocks (like the oil crises of the 70s), misguided government policies, or a wage-price spiral where rising wages push up prices, which in turn leads to demands for higher wages.

The fundamental distinction lies in the price movement and economic growth dynamic. Deflation involves falling prices alongside sluggish or negative growth, primarily due to a lack of demand. Stagflation, conversely, couples rising prices with stagnant growth and high unemployment, often driven by supply-side issues or persistent inflationary expectations. For policymakers, the challenges are immense: traditional monetary and fiscal tools designed to combat inflation might exacerbate unemployment, and vice-versa. Understanding these nuanced economic states is crucial for navigating financial landscapes and anticipating the strategies employed by central banks and governments to restore equilibrium.