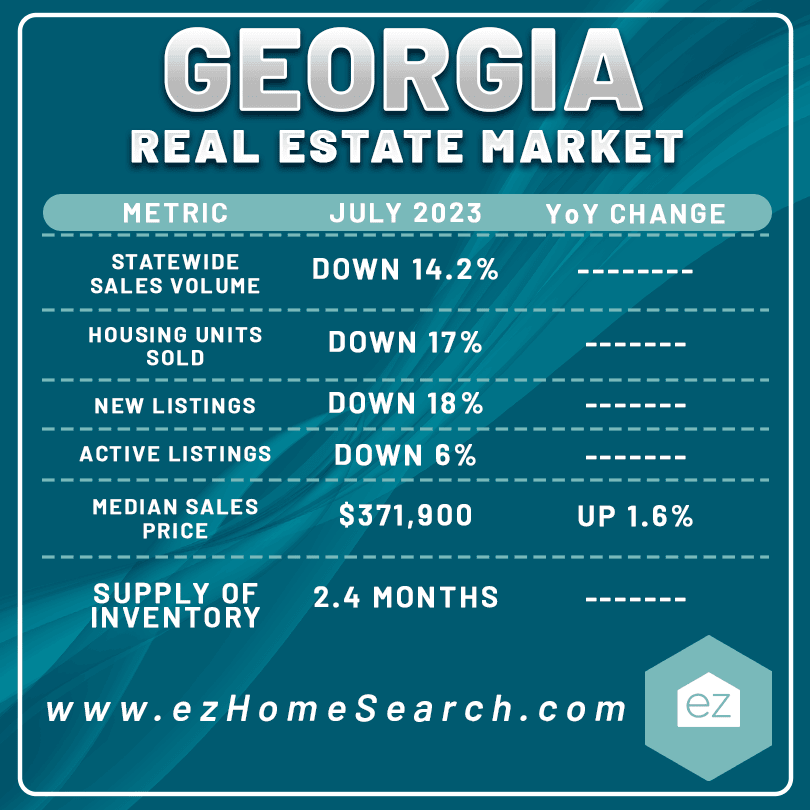

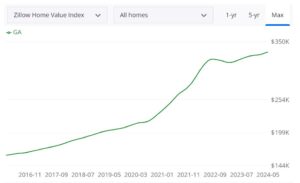

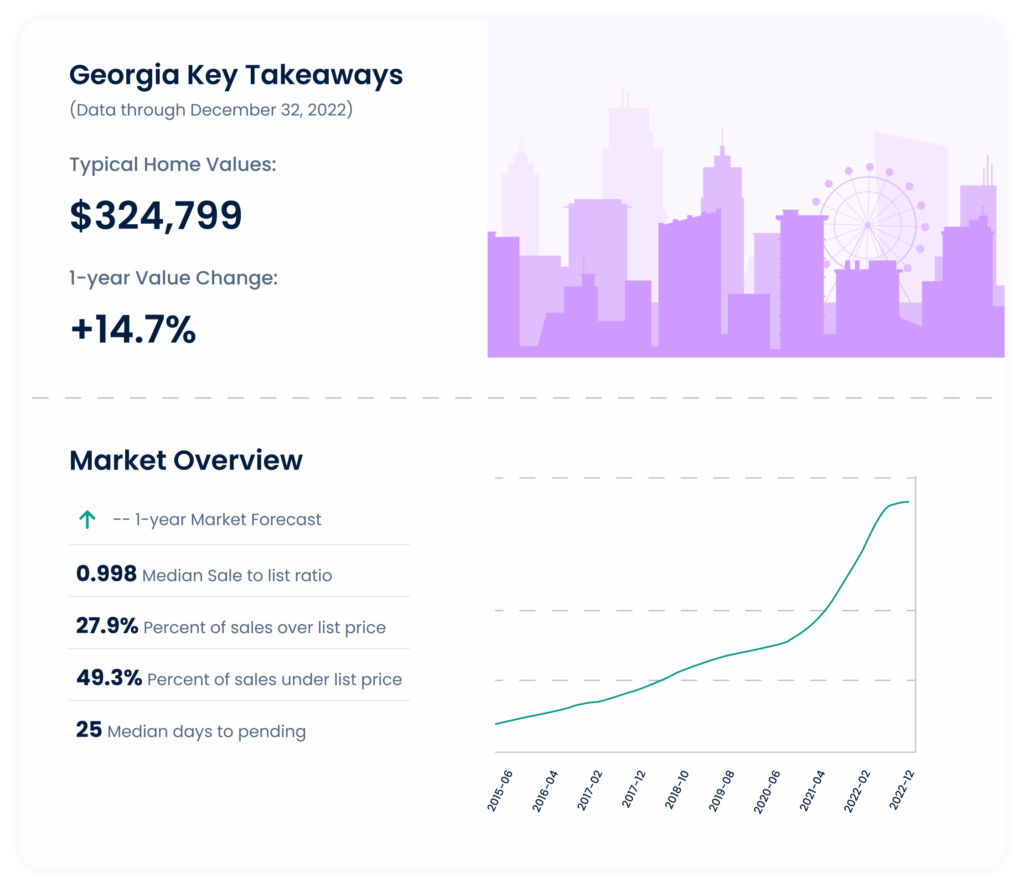

The Georgia real estate market has been a subject of considerable interest and speculation, marked by a dynamic interplay of growth and localized variations. For homeowners in the Peach State, the question of whether their property's value will endure, or even appreciate, is paramount. Recent data paints a complex picture: while some reports indicate slight year-over-year decreases in average home values, other prominent analyses suggest continued, robust appreciation. For instance, Redfin noted a 2.4% increase in Georgia home prices in August 2025 compared to the previous year, with a median price of $381,100. Similarly, Houzeo reported a 2.3% year-over-year growth in January 2025. These figures collectively underscore a market that, for the most part, has defied widespread downturns, maintaining its allure for both residents and investors.

The resilience and, in many areas, the accelerated growth of Georgia's housing market can be attributed to a confluence of factors. High demand, fueled by population growth and attractive economic prospects, continues to outpace available inventory. While thousands of new listings emerge each month, they are often insufficient to cool down price increases drastically across all segments. This supply-demand imbalance, a hallmark of many thriving markets, has led to a peculiar paradox: Georgia, particularly Atlanta, has been identified by Florida Atlantic University as having the most overpriced housing market in the United States. This suggests that while values are rising, they might also be stretched beyond what fundamental economic indicators would typically support, creating an environment ripe for careful observation.

So, will the real estate market reduce the value of your home in Georgia? Current expert consensus largely leans against a widespread market crash, even with pockets of overvaluation. Organizations like Norada Real Estate do not predict a crash, emphasizing the underlying strength. However, the nuance is critical. While broad state-level averages show appreciation, micro-markets within Georgia can behave differently. Factors such as local economic health, specific neighborhood demand, inventory levels, and interest rate fluctuations can all influence individual property values. A homeowner in a rapidly developing suburban area might experience different trends than someone in a less dynamic rural or urban core, even within the same state.

Ultimately, the Georgia real estate market, like any significant financial landscape, demands vigilance and an understanding of both macro trends and hyper-local conditions. While the overarching narrative suggests a market largely resistant to significant value reductions, marked by continued demand and appreciation in many areas, property owners should remain informed about specific forecasts for their regions. Engaging with local real estate professionals and staying abreast of economic indicators will be key to understanding the trajectory of your home's value in this complex, yet often rewarding, market.